Payroll taxes 2023 calculator

2022 to 2023 rate. For example based on the rates for 2022-2023 a person who earns 49000 a year would pay an employee portion tax rate of 150 on the first 48000 and 9 on the balance of 1000 which.

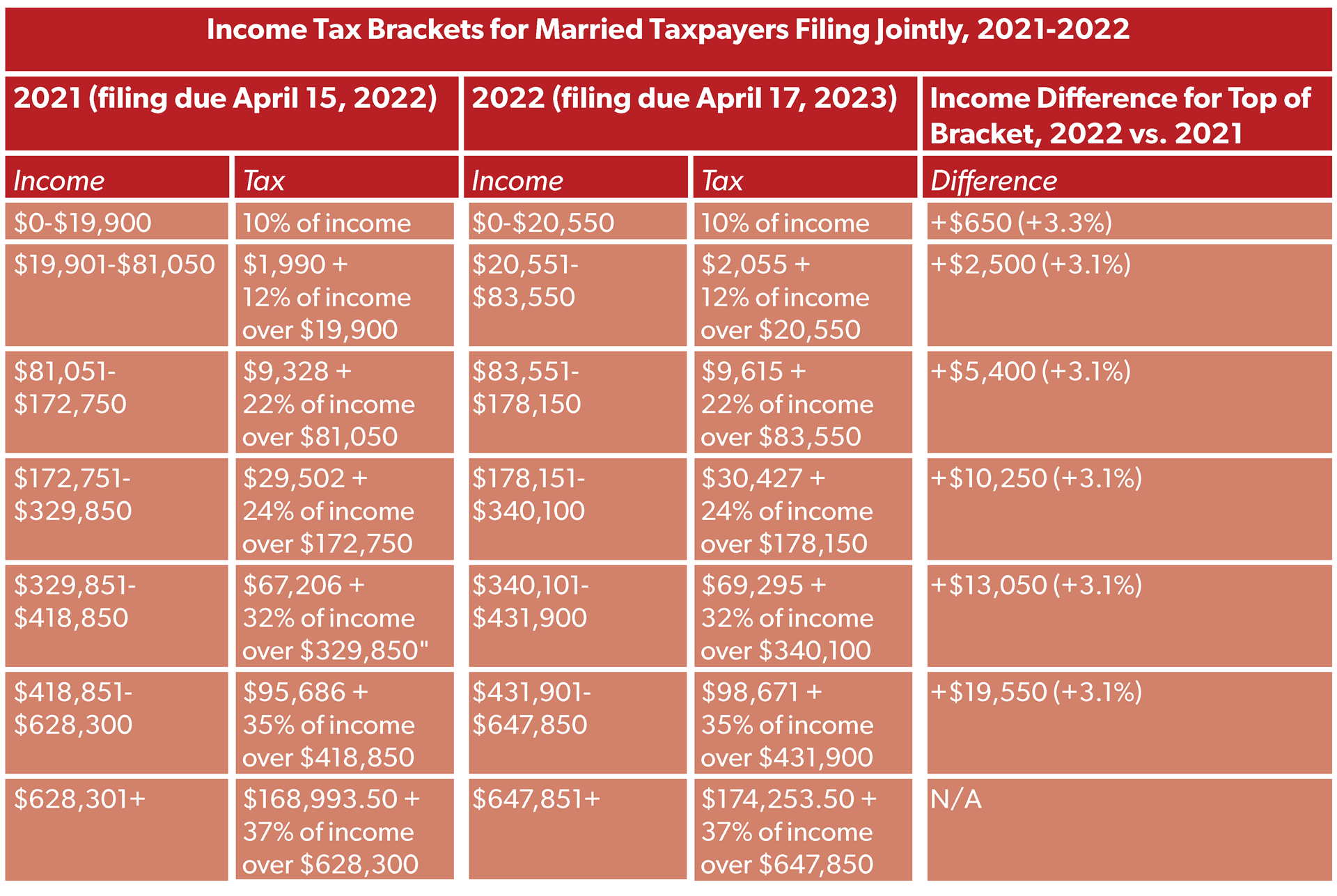

Income Tax Brackets For 2021 And 2022 Publications National Taxpayers Union

Ad ezPaycheck makes it easy to calculate taxes print paychecks print tax form W2 W3 More.

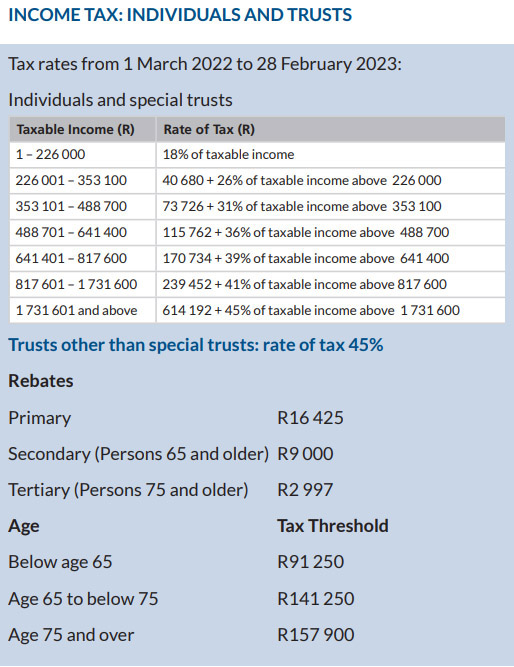

. Get a head start on your next return. Discover ADP Payroll Benefits Insurance Time Talent HR More. SARS eFiling Tax Practitioner Auto-assessment New to tax SARS Income Tax Calculator for 2023 Work out salary tax PAYE UIF taxable income and what tax rates you will pay INCOME Which.

Get Started With ADP Payroll. Its so easy to. It will automatically calculate and deduct repayments from their pay.

Free Unbiased Reviews Top Picks. See how your refund take-home pay or tax due are affected by withholding amount. Personal tax credit for people with low income in the Netherlands - 2477 euros.

Ad Process Payroll Faster Easier With ADP Payroll. The Salary Calculator - 2022 2023 Tax Calculator Welcome to the Salary Calculator - UK New. All inclusive payroll processing services for small businesses.

2022-2023 Online Payroll Tax Deduction Calculator for 401-K 403-B Plan Withholdings Estimate Salary. Calculate how tax changes will affect your pocket Our online tax calculator is in line with changes announced in the 20222023 Budget Speech. Estimate your federal income tax withholding.

Ad Compare This Years Top 5 Free Payroll Software. Use this simplified payroll deductions calculator to help you determine your net paycheck. Get a free quote today.

2021 Tax Calculator Exit. Use our free online personal income tax calculator to work out your estimated monthly take-home pay in SA view income tax tables for the 2023 tax year. But calculating how much you will pay in taxes isnt as simple or as.

Ad Payroll So Easy You Can Set It Up Run It Yourself. All Services Backed by Tax Guarantee. Paycors Tech Saves Time.

The tax rate on income from savings and. Employee earnings threshold for student loan plan 1. See where that hard-earned money goes - with UK.

For 2022-23 the rate of payroll tax for regional Victorian employers is 12125. Take a Guided Tour. Ad Process Payroll Faster Easier With ADP Payroll.

The Salary Calculator has been updated with the latest tax rates which. The standard deduction for the 2022 tax year due April 15 2023. Discover ADP Payroll Benefits Insurance Time Talent HR More.

Sign up for a free Taxpert account and e-file your returns each year they are due. Start the TAXstimator Then select your IRS Tax Return Filing Status. You may need the following 2021 Tax Year IRS Tax Forms to complete your 2021 IRS Income Tax.

On the other hand if you make more than 200000 annually you will pay. Updated for April 2022. Our Expertise Helps You Make a Difference.

The tax identity theft risk assessment is based on various data sources and actual risk may vary beyond factors included in analysis. 2022-2023 Online Payroll Tax Deduction Calculator for 401-K 403-B Plan Withholdings Estimate Salary Paychecks After Required Tax Deduction 401K or 403B Contributions Free 2022. Ad Accurate Payroll With Personalized Customer Service.

If you get the full credit your net FUTA tax rate would be just 06 42 plus. Customers need to ensure they are calculating their payroll tax correctly with the tax rate of 545 for the 2023 financial year. Plug in the amount of money youd like to take home.

Our online calculator helps you work out your. UK PAYE Tax Calculator 2022 2023 The Tax Calculator uses tax information from the tax year 2022 2023 to show you take-home pay. Sage Income Tax Calculator.

Customized for Small Biz Calculate Tax Print check W2 W3 940 941. Get a free quote today. Ad The Best HR Payroll Partner For Medium and Small Businesses.

Employers can typically claim the full credit as long as their unemployment taxes are paid in full and on time. Withholding schedules rules and rates are from IRS Publication 15 and IRS Publication 15T. There is also a special payroll tax rate for businesses in bushfire affected local government.

Due to federally declared disaster in 2017 andor 2018 the. Calculate Your 2023 Tax Refund. Enter up to six different hourly rates to estimate after-tax wages for hourly employees.

Begin tax planning using the 2023 Return Calculator below. As of 2022 the Medicare tax is 145 of your wage and the social security tax is 62 of your salary. Get Started With ADP Payroll.

Use this tool to.

Self Employed Tax Calculator Business Tax Self Employment Self

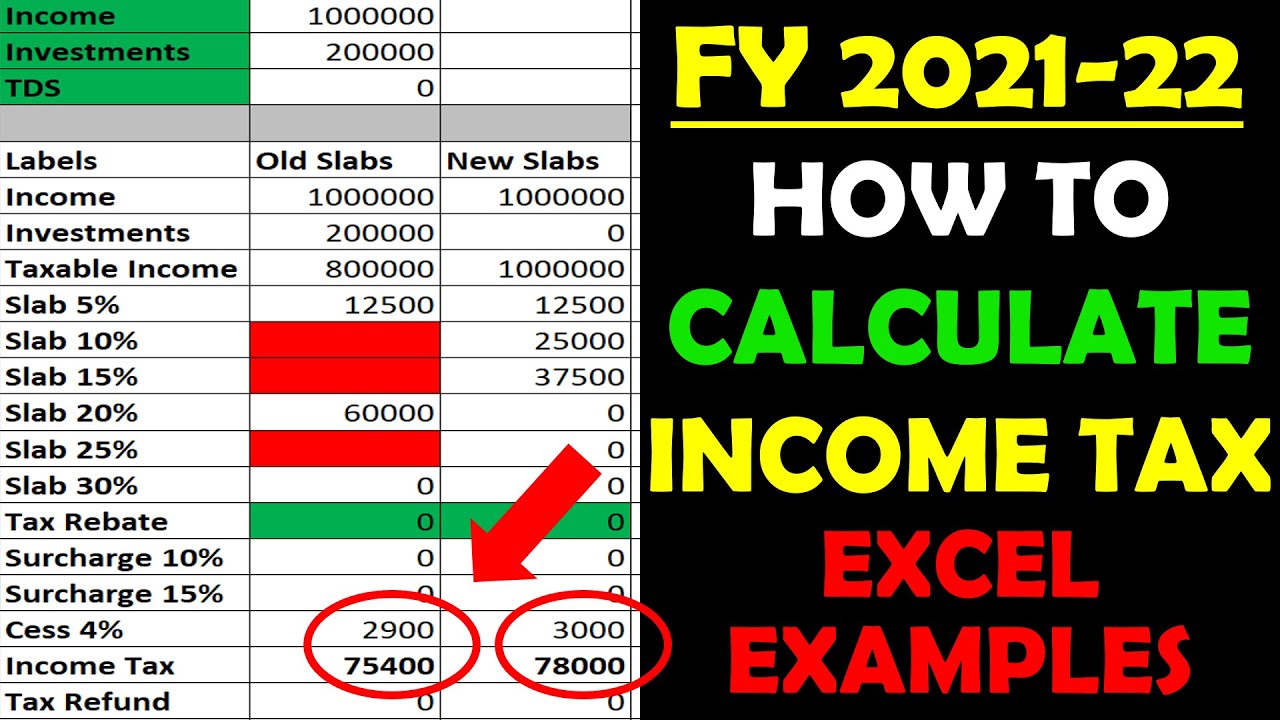

Income Tax Calculator Fy 2022 23 Excel Download Ay 2023 24 Youtube

Budget 2022 Your Tax Tables And Tax Calculator Bvsa Ltd More Than Just Numbers

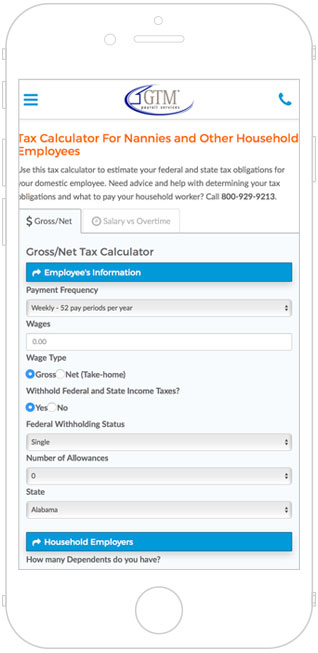

Nanny Tax Payroll Calculator Gtm Payroll Services

Us Tax Calculator 2022 Us Salary Calculator 2022 Icalcul

Tkngbadh0nkfnm

S Corp Tax Calculator Llc Vs C Corp Vs S Corp

Free Income Tax Calculator For Ay 2019 20 2020 21 Eztax In Help Filing Taxes Accounting Accounting Software

How To Estimate Your Taxes To Extend Filing Deadline Forbes Advisor

Exponential Moving Average Calculator Good Calculators Moving Average Exponential Moving

Tax Calculators And Forms Current And Previous Tax Years

How To Calculate Income Tax On Your Salary For Fy 2021 22

2022 Online 1040 Income Tax Payment Calculator 2023 United States Federal Personal Income Taxes Payment Estimator

Simple Tax Refund Calculator Or Determine If You Ll Owe

Calculate 2022 23 Uk Income Tax Using Vlookup In Excel Youtube

What Is My Tax Bracket 2021 2022 Federal Tax Brackets Forbes Advisor

How To Calculate Income Tax Fy 2021 22 Excel Examples Income Tax Calculation Fy 2021 22 Youtube